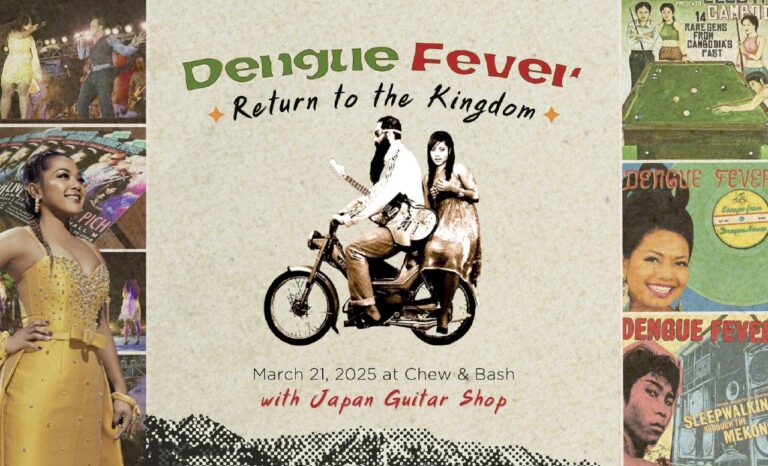

Legendary rock band Dengue Fever, returns to the Kingdom for the first time since 2016, bringing the heat back to Phnom Penh

On March 21st, the beloved Cambodian-American band, Dengue Fever, returns to the country for the first time in nearly a decade for an action-packed show with Japan Guitar Shop at Chew & Bash, Phnom Penh Island Club